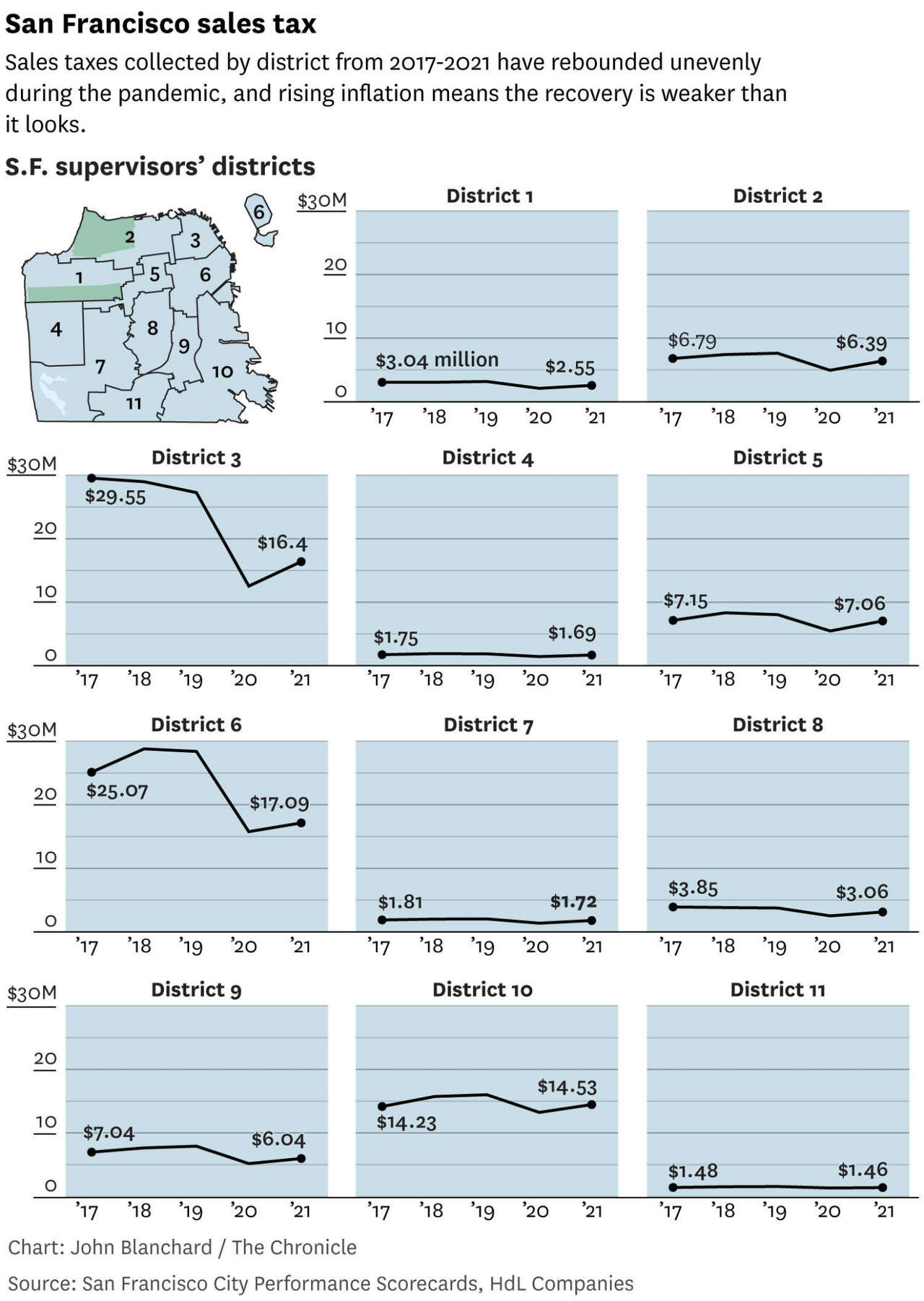

san fran sales tax rate

0875 lower than the maximum sales tax in CA The 8625 sales tax rate in San Francisco consists of 6 California state sales tax 025 San Francisco County sales tax and 2375. The minimum combined sales tax rate for San Francisco California is 85.

California State Taxes 2021 2022 Income And Sales Tax Rates Bankrate

Until 2018 all businesses with a taxable San Francisco payroll expense greater than 150000 must file a Payroll Expense Tax Statement for their business annually by the last.

. The California sales tax rate is currently 6. The San Francisco County California sales tax is 850 consisting of 600 California state sales tax and 250 San Francisco County local sales taxesThe local sales tax consists of a. This is the total of state county and city sales tax rates.

San Francisco Californias minimal combined sales tax rate for 2020 is 85 percent. Monday through Friday in room 140. The current total local sales tax rate in San Francisco CA is 8625.

The average cumulative sales tax rate in San Francisco California is 864. City Hall Office Hours. 1788 rows California City County Sales Use Tax Rates effective October 1 2022 These rates may be outdated.

This is the sum of the sales tax rates in the state county and city. For a more detailed breakdown of rates. This is the total of state county and city sales tax rates.

California requires S corporations to pay a 15 franchise tax on income with a minimum tax of 800. Effective January 1 2017 the partial state tax exemption rate. You can also use Sales Tax calculator at the front page where you can fill in percentages by yourself.

The minimum combined sales tax rate for San Francisco California is 85. See reviews photos directions phone numbers and more for Sales Tax Rate locations in San Francisco CA. For a list of your current and historical rates go to the.

750 2022 South San Francisco sales tax Exact tax amount may vary for different items Download all California sales tax rates by zip code The South San Francisco California sales. Walk-ins for assistance accepted until 4 pm. The base sales tax in California is 725.

Choose city or other locality from San Francisco. San Francisco County CA Sales Tax Rate The current total local sales tax rate in San Francisco County CA is 8625. The December 2020 total local sales tax rate was 8500.

The December 2020 total local sales tax rate was 8500. The statewide sales and use tax rate decrease of 025 percent affects certain partial state tax exemptions. This includes the rates on the state county city and special levels.

Sales Tax Breakdown San Francisco. The Office of the Treasurer Tax Collector is open from 8 am. The California sales tax rate is currently 6.

In addition an individual S-Corp shareholder will owe tax.

California Used Car Sales Tax Fees 2020 Everquote

How Much Is Weed Tax In San Francisco Lajolla Com

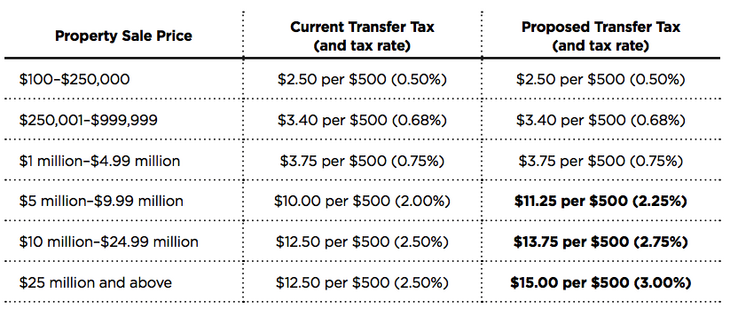

San Francisco Prop W Transfer Tax Spur

San Francisco Feels A Tax Base Chill With First Drop In 25 Years Bloomberg

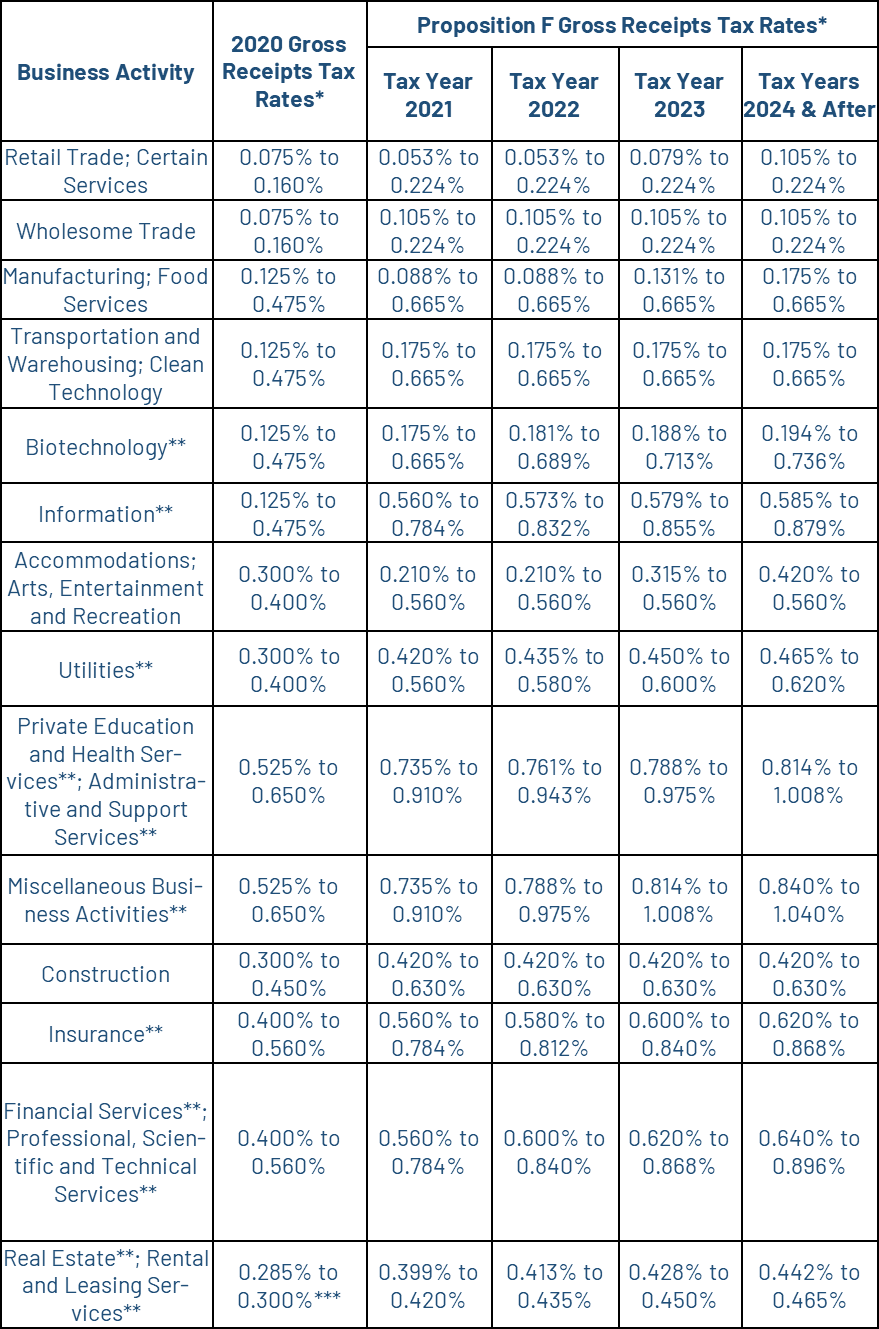

Gross Receipts Tax Gr Treasurer Tax Collector

What Is Form 1099 K Woocommerce

San Francisco Voters Approve New Taxes For Wealthy Ceos And Tech Companies San Francisco The Guardian

New York Taxes Layers Of Liability Cbcny

What You Should Know About Sales And Use Tax Exemption Certificates Marcum Llp Accountants And Advisors

Sales Tax Analyst Resume Samples Velvet Jobs

Sales Tax Is Rising In San Francisco And These Bay Area Cities This Week

Tax Guide Best City To Buy Legal Weed In California Leafly

Why Households Need 300 000 To Live A Middle Class Lifestyle

State And Local Sales Tax Rates Sales Taxes Tax Foundation

Reality Check Only Bc S Very Richest Paying Higher Tax Rate Policy Note

How Much Is Weed Tax In San Francisco Lajolla Com

San Francisco Prop K Sales Tax For Transportation And Homelessness Spur

San Francisco Taxes Where Does The Money Go By Michael Sutyak Medium

:max_bytes(150000):strip_icc()/buying-vs-renting-san-francisco-bay-area-ADD-V2-d0efaf2b7ac346bbba2c1ac389751ef1.jpg)